How To Solve For Effective Interest Rate In Excel

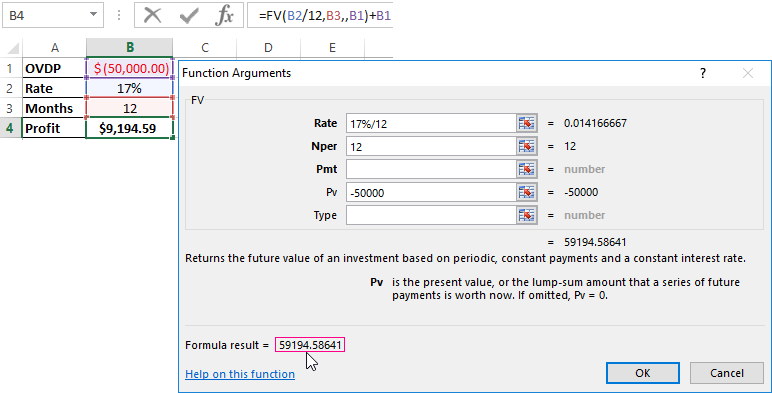

In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. The Annuity Calculator was designed for use as a retirement calculator where withdrawals are made each year.

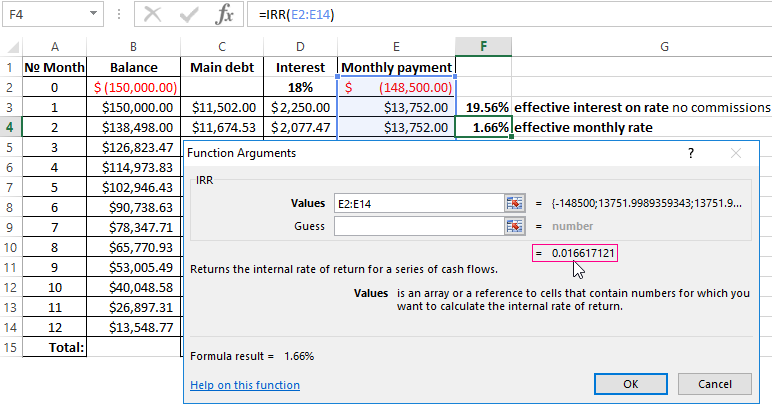

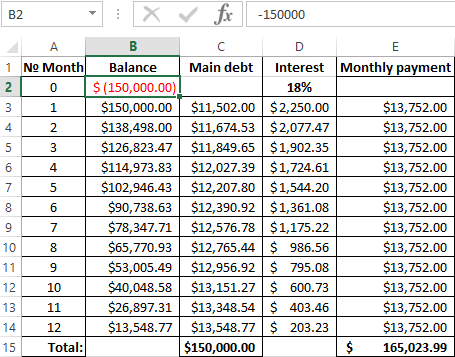

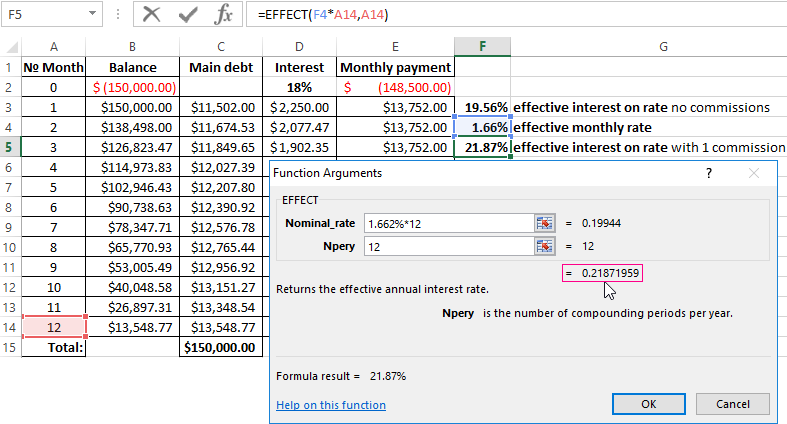

Calculation Of The Effective Interest Rate On Loan In Excel

In one of our previous articles we unveiled the power of compound interest and how to calculate it in Excel.

How to solve for effective interest rate in excel. You can use goal seek to calculate the interest rate you will need to secure with your friend. There is n number of complex problems which you can solve with goal seek. For given C P and N one can only solve the following equation for r by numerical means.

Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded. The three components of What-If analysis are Scenario Manager Goal Seek in Excel and Data Table in Excel. The detailed explanation of the arguments can be found in the Excel FV function tutorial.

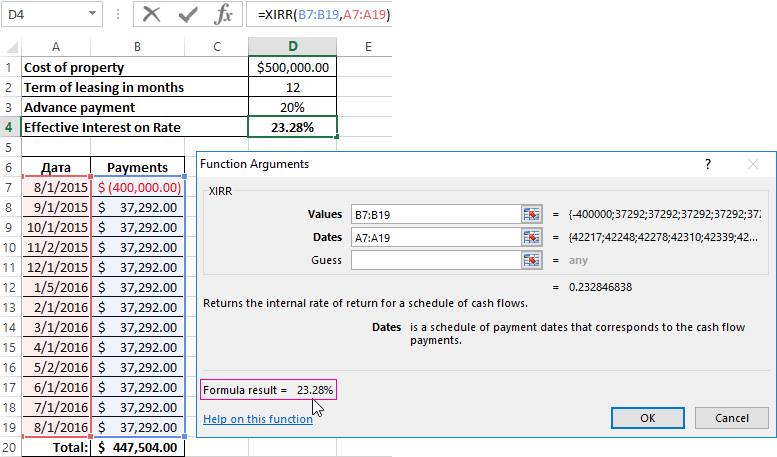

The cash interest is calculated by taking the coupon rate of the bond 9 and multiplying it by the bonds face. In our example the market interest rate on January 1 2020 was. You need the beginning value interest rate and number of periods in years.

After one year you have 100 in principal and 10 in interest for a total base of 110. Use this guide as a resource each time you create a piece of content to ensure. Periodic Interest Rate P.

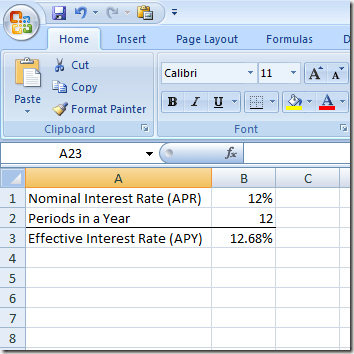

As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded monthly with no additional. For instance when an interest rate is stated as 10 compounded monthly the effective rate will be higher than 10. N Total number of payments.

Or lets say 100 is the principal of a loan and the compound interest rate is 10. 9358234 X 10 938554. The effective interest rate method uses the market interest rate at the time that the bond was issued.

The stated interest rate. But Excel is more powerful than that because of these so-called functions. To solve the equation youll need to find the numbers for these values.

P Initial principal loan amount r Interest rate per period. Today well take a step further and explore different ways to compute Compound Annual Growth Rate CAGR. Under the effective interest rate method the amount of interest expense in a given accounting period will correlate with the amount of a bonds book value at the beginning of the accounting period.

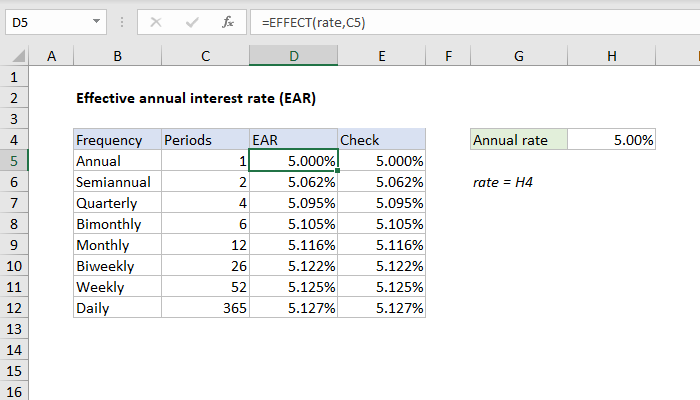

Before we demonstrate the effective interest rate. The EFFECT function computes the effective interest rate. A very basic fixed-annuity calculator assumes the withdrawals are constant for n years.

Interest Rate R. Here row inputs consist of changes in Cost of capital or WACC 7 to 11. A Payment amount per period.

Number of Periods t enter more than 1 if you want to calculate an effective compounded rate for multiple periods Compounded Interest Rate I when number of periods is greater than 1 this will be the total interest rate for all periods. For example if you borrow 100000 from your brother and promise to pay him back all the money plus an extra 25000 in 5 years you are paying an implicit interest rate. Dont get the inflation adjustment of the withdrawal amount mixed up with the terms.

However the reality is that the withdrawal amount will most likely need to increase each year due to inflation. Now you have this guide to help you decide on the best types of content to create for the buyers journey stages and how to use each most effectively to nurture buyers toward a sale. It can be difficult to determine the best type of content to create for each of the buyers journey stages.

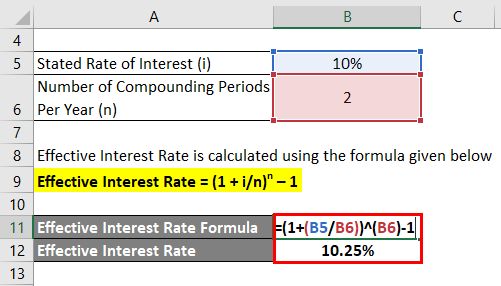

Units Time Month 30 Days. Which tells Excel the data is increasing and to return the index the closest value greater than the sought value. Then plug this information into the formula r 1 inn - 1 where i is the stated interest rate n is the number of compounding periods and r is the effective.

An implicit interest rate is the nominal interest rate implied by borrowing a fixed amount of money and returning a different amount of money in the future. Excel is a great way to organize and keep track of your data. To reach the formula for compound interest you algebraically rearrange the formula for CAGR.

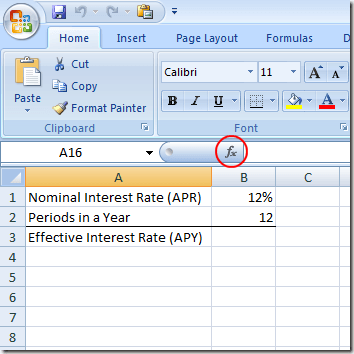

Calculate the value on the left and solve for r. There are more than 100 functions in Excel. To calculate effective interest rate start by finding the stated interest rate and the number of compounding periods for the loan which should have been provided by the lender.

Given the rather smooth behavior of this equation this calculator employs the Newton-Raphson method with an educated initial guess. This figure is the interest expense for year one. Lets say you get an auto loan for 10000 at a 75 annual interest rate for 5 years after making a 1000 down payment.

Effective Interest Rate i is the effective interest rate or effective rate. This means that as a bonds book value increases the amount of interest expense will increase. 10481 1 r.

Jefferson earned the annual interest rate of 481 which is not a bad rate of return. Or at least it was. The tutorial explains what the Compound Annual Growth Rate is and how to make a clear and easy-to-understand CAGR formula in Excel.

Your formula needs to be MATCHB2B6B22-1 which tells Excel the data is decreasing and to return the index the closest value less than the sought value. Number of times the interest will compound per year. So today in this post youll learn how to use goal seek in Excel how it works and what are the.

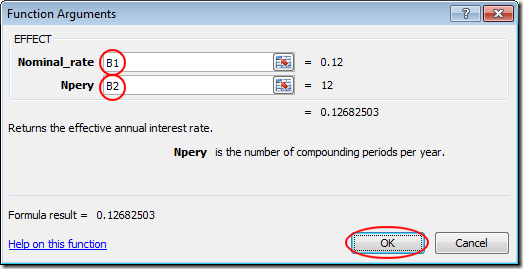

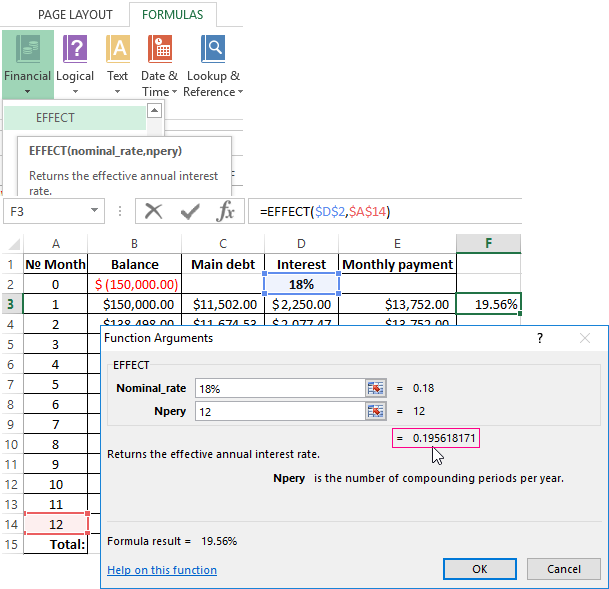

This means that the Cash account will be credited for 4500 on each interest payment date. But theres no need to learn them all especially at once. EFFECT nominal_rate npery Nominal_rate.

Read more in a professional way on the above data then we get the following output.

Use Excel To Figure Out An Effective Interest Rate From A Nominal Interest Rate

Calculation Of The Effective Interest Rate On Loan In Excel

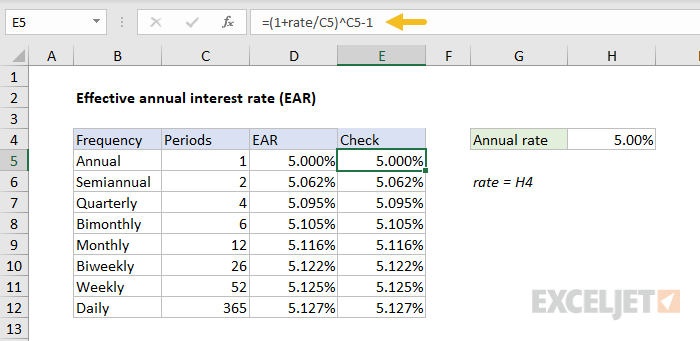

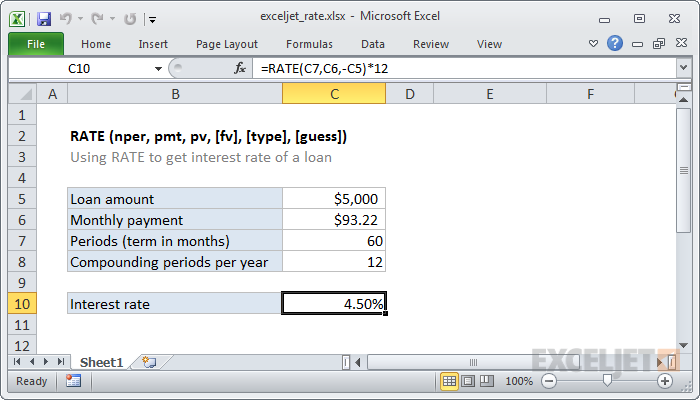

Excel Formula Effective Annual Interest Rate Exceljet

Effective Interest Rate Formula Excel Free Calculator

Calculation Of The Effective Interest Rate On Loan In Excel

Effective Interest Rate Formula Excel Free Calculator

Use Excel To Figure Out An Effective Interest Rate From A Nominal Interest Rate

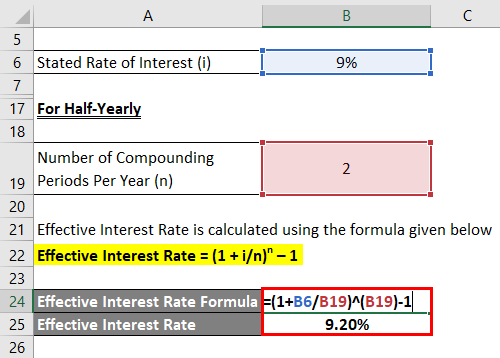

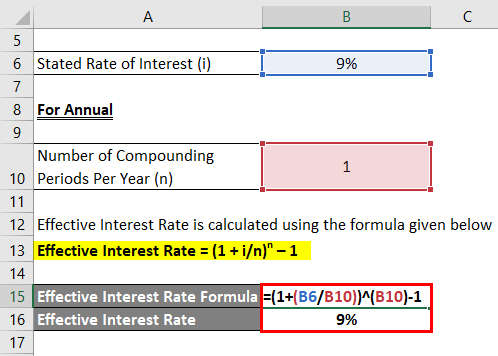

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

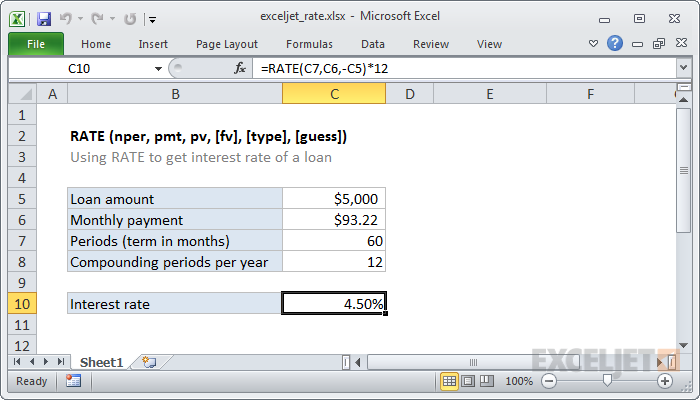

How To Use The Excel Rate Function Exceljet

Effective Interest Rate Formula Calculator With Excel Template

Calculation Of The Effective Interest Rate On Loan In Excel

How To Use The Excel Effect Function Exceljet

Effective Interest Rate Formula Excel Free Calculator

Excel Formula Effective Annual Interest Rate Exceljet

Calculation Of The Effective Interest Rate On Loan In Excel

Use Excel To Figure Out An Effective Interest Rate From A Nominal Interest Rate

Calculation Of The Effective Interest Rate On Loan In Excel

How To Calculate Effective Interest Rate On Bonds Using Excel